America 3.0 & The Interregnum

This speech was presented at the Annenberg Research Park Colloquium at USC on October 14, 2008. The video of the same talk in front of my Annenberg School Master's Seminar is below.

Please watch it in the High Quality setting. I want to try to help you make sense this morning of the current economic crash and the roll of the disciplines we study here at Annenberg in getting us out of a mess that has been thirty years in gestation. I started a blog, as a lot of you know, on Christmas night of 2007, and I wrote that I was very hopeful about a lot of things but I had a sense of dread also and I said that "the aforementioned dread comes from a sense of profound economic peril. We've lived as a country off of rich inheritance of past generations and now the party may be coming to a close."

I have since chronicled this horrible situation for quite awhile and I don't really like being right but what happened is best summarized by Nouriel Roubini who is an economist at NYU who has also been on this beat and he said last week "a housing bubble, a mortgage bubble, an equity bubble, a bond bubble, a credit bubble, a commodity bubble, a private equity bubble, a hedge funds bubble are all now bursting at once in the biggest real sector and financial sector de-leveraging since the Great Depression." Needless to say, I don't need to tell you, as you look at your stock portfolios, that the last year has been one of the worst years ever in the history of the stock market. And actually, although the unemployment rate is officially at 6.1 percent it is actually much higher. This is what is known as "hidden unemployment" and by this measure at 11% of the adult population are out of work because anyone who is working part-time or who is not looking for a job actively is not gonna be counted in the unemployment statistics.

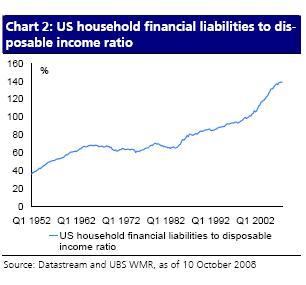

Now the conventional wisdom is that this is all caused by a housing bubble but I would say that the real culprit is the fact that over the last 20 years or 30 years the household financial liabilities to disposable income has gone to levels that we never saw before and are levels, needless to say, that were unsustainable. When your liabilities are close to 160 percent of your disposable income there is no way to keep this game going.

What we will now have to face is a crisis of overcapacity and deflation. There are, quite frankly, way too many auto plants in this country and globally there are too many apparel plants, too many shoe factories and the worldwide overcapacity in many sectors is something that we're gonna have to deal with. Needless to say, what happened today with the investment of $250 billion into our banks and the partial nationalization of the eight largest banks in America will lead to a cleaning out of the over-capacity in the financial sector. We will see probably 100 to 200 banks go out of business in the next few months. Their deposits will be taken in by, as I call, "the chosen ones". The Treasury has decided these eight banks get to stay and everybody else can go.

So what I am suggesting is that we need to reinvent the operating system of the American economy. I call this America 3.0 and so first I have to talk about what was America 1.0 and what was America 2.0.

America 1.0 was obviously a country founded on the principles of Jefferson; of equality and the pursuit of life, liberty and happiness. But it was also a country that was founded on Washington's famous address that "it will be our policy to cultivate tranquility at home and abroad and extend our commerce as far as possible." In other words, from 1776 to 1915 we were a country that was interested in peace at home and abroad and basically being a commercial power. We did not participate in the great imperialism of the 19th Century. But in 1917 that changed, with the messianic Wilsonian notion that we would make the world safe for democracy. From that moment forward, we engaged the world in a much different way--a military way and it was the beginning of what I think is a reluctant empire. This was America 2.0.

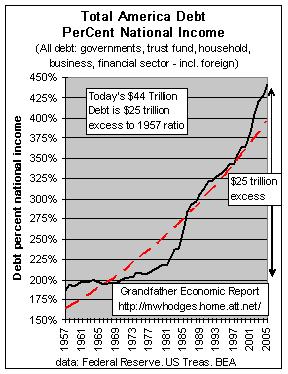

In 1980 there was an interim modification to the Wilsonian system that I call America 2.5: the conservative counter-revolution with its front men in Ronald Reagan, Rush Limbaugh and Newt Gingrich and its backstage intellectual progenitors like Irving Kristol, who wrote in The Public Interest in 1965 that "in domestic affairs the national government should shrink by cutting taxes and business regulations and in foreign affairs the government should grow by becoming the world's sole military superpower." Now I'm going to argue that at its economic core this was a ridiculous idea because obviously if you shrink the tax base you shrink the amount of money you have to pay for a foreign empire. This creates a huge problem that Reagan solved by borrowing from the rest of the world. Now this theory reached its apotheosis in the Bush doctrine; the notion that we could have preemptive wars. The Pentagon named it The Long War: assuming we would be in an endless war fighting terrorism. And this endless war cost us about $11 billion per month and of course we continued to cut taxes, so we had to borrow more.

This lead to an extraordinary credit problem and by the midpart of the Bush administration, the total credit market debt of the US as a percentage of US GDP had reached back to the levels that it had been in 1929 just before the Crash. So that we had accumulated $44 trillion in debt and that debt bubble is really the basis of what is happening now--Creative Destruction. We often use lightly the term "creative destruction", Schumpeter's idea that it is the driving force of capitalism is that most businesses, no matter how strong they seem at a given moment, ultimately fail and they always fail because they fail to innovate. And this destruction something that we are going to see around the world in the next 24 months.

We are, I argue, in what Gramsci called an interregnum. Gramsci said "The old is dying and the new cannot be born. In this interregnum there arises a great diversity of morbid symptoms." The first interregnum was the English Civil War, the English Civil War when Charles I had his head cut off in 1649 and Cromwell ruled for 12 years before Charles II was restored. But I am not using the term interregnum in that sense but in a more metaphorical sense and so the beginning of the 20th century was the kind of interregnum I'm trying to depict. Sometimes the leaders of the world don't understand that things have profoundly changed. When Queen Victoria died in 1901 all the kings and emperors and crown princes of Europe--who walked behind the horse-drawn caisson in her funeral, because there were no cars--ruled more than half the world's people. The British Empire alone ruled a quarter of the world's people and the English pound sterling was the reserve currency for all financial transactions. But these feudal leaders didn't have any clue that at the very moment that this was going on Marconi was erecting the first wireless antenna in southern England to link across the ocean to Nova Scotia. That Sigmund Freud was publishing his early papers about the subconscious. That Albert Einstein had filed his first paper about a unified field theory. That Henry Ford was tinkering in his garage and the Wright Brothers were tinkering in their garage and so this extraordinary technological revolution that was going on that was completely unknown to the rulers of the world.

I believe we're in a very similar situation and that the revolution that I think we're confronting is one that is best laid out in this matrix.

The matrix asks the question 'What will the next ten years be like' and on the horizontal scale, it says 'Will the global economic and cultural influence of the US decrease or increase?' And this vertical scale is "Where will the sources of leadership, innovation and change come from?" Will they come from decentralized, network, bottom-up forces, or will they come from centralized hierarchical, top-down forces?'

George Bush and Dick Cheney don't understand that we are living in a decentralized, networked world and so their responses to almost every crisis are wrong. The first response of the Bush administration to the credit crisis was a centralized, hierarchical, top-down responses and, needless to say, that didn't work. Who were we fighting in Iraq? Certainly not a hierarchical centralized army, but a bottom-up, networked guerilla force. And their notion, for instance, that you could let Lehman Brothers fail and nothing really would happen turned out to be totally wrong because Lehman Brothers was part of a totally networked world and when it failed so many other things failed.

So like the British experience one century ago we may be at the end of another empire. I don't need to tell a gathering of academics that empires always end and sometimes they end in fairly decadent circumstances as with the Romans. And sometimes countries give up their imperial ambitions and get along just fine without all the hassle as did the United Kingdom. Most people who study the end of empires think that there are four characteristic problems; one is what is called imperial overstretch, one is cultural decline, one is accelerated inequality, and the final is scientific regression. So let's look at imperial overstretch. The most obvious factor that pops out at you is that last year's budget, 56 percent of our discretionary spending went to the military. Six percent went to healthcare; eight percent went to all educational training and social services.

As Joe Stiglitz, former chief economist of the World Bank says, we might have better spent the $2 trillion that we're gonna spend in Iraq on domestic problems and it would've made us stronger. But we have a bigger problem which is what game theorists call the free rider problem.

This is our defense spending compared to all our commercial rivals. In this world where we voluntarily provide a defense umbrella, it's relatively easy for France or Germany to spend money on a national care health system which then lifts the burdens on their corporations to spend money on healthcare. Whereas we spend money on the military and basically what does it get us? Well, we don't get oil any cheaper than they get it in Japan or anything else. The early British imperialist system said 'we will have competitive advantage with our rivals because when we control these countries in the Gulf, Africa or in India, we will be able to control their resources. But in a post colonial world we get no advantage spending $10 billion a month in Iraq, for we pay the same price per barrel of oil as do the Chinese and the Japanese. In fact, our outflow of $700 billion a year for oil which remember is mostly borrowed money from China and Russia, just makes things worse. The reason we have to borrow all this money is, of course, that we don't save any money. The actual personal savings rate in the United States went below zero in 2000 and has never recovered. That meant that the average person was spending more than they earned and they, needless to say, was borrowing it from their houses.

Now the second sign of imperial decline is scientific regression. If you go outside of Louisville, Kentucky you can visit the Creation Museum where you will learn that the world was created 5,000 years ago and dinosaurs and man walked at the same time. And you will see a whole exhibit of all these things that prove that evolution is just a fake. So what happens when we teach this nonsense to our children rather than insisting on real science? Well in a chart of the 12th grade science scores around the world the U.S. ranks somewhere between 22nd and 28th in the world in, ranking behind Portugal and Hungary. In healthcare we rank 23rd, in infant mortality 20th, in life expectancy for women 21st, in life expectancy for men and you should know that we used to be first in most of these categories right after the World War II. We spend 40 percent more per capita on healthcare than any other industrialized country with universal healthcare. Needless to say, we've also ignored global warming even though every serious scientist says it is a reality.

And because both the auto and oil industries, with their massive lobbying clout have made sure that gasoline stays cheap we are by far, least efficient country in terms of energy usage in the developed world. And of course now the Big 3 automakers are having to pay for their refusal to deal with the realities of peak oil and global warming. Gm's Vice-Chairman Bob Lutz recently opined that Hybrids would never sell in American and global warming was a "crock of s**t". With dinosaurs like this running these companies, it's no wonder they are on the verge of bankruptcy. Here again, creative destruction will take its toll and Bob Lutz will retire to Palm Springs with his Cadillac Escalade. Because of the stupidity of auto executives feeding our dependence on foreign oil, Dick Cheney felt we needed to control the oil in the Gulf Region and so we went to war in Iraq for oil, as Alan Greenspan acknowledged. And because we fight wars for oil US businesses become the focus of foreign anger. In Islamabad, when they're pissed off, the first thing they do is burn down the KFC or the McDonald's and so operating in a world of anti-imperialistic anger is not easy. Hopefully, a new administration can address this basic problem for Brand America.

Now the third sign of this era is cultural decline. In the '50s John Galbraith wrote a pretty interesting book called The Affluent Society and he basically said "It can no longer be assumed that welfare is greater at an all around higher level of production than at a lower one. The higher level of production is merely a higher level of want creation necessitating a higher level of want-satisfaction." In other words he basically said that the average middle-class citizen was like the gerbil on the treadmill; he was not gaining status altitude in relation to his peers, but merely spending more money to stay even. Because we have learned ways to imbed advertising everywhere you looked, we were able to constantly drive people to buy things they didn't need. But it seems to me this world is ending, and every sign points to a major pullback by the consumer at the mall. But, needless to say, there were a lot of people who never participated in this buying frenzy and who are very disconnected from the middle class world; black unemployment for teenagers who dropped out of high school is 72 percent. 17 percent of the homeless are between the ages of 22 and 30 years. And this has lead not only in our own country but to other countries to a certain level of civil unrest where outside of Paris on any given Friday night cars are burned in the Arab banlieus; where in Rio people live in tin shacks in favellas right next to the rich living in high-rise condos. And when Katrina hit we saw our own unpeeling of the onion of civility so that the deep, deep poverty of the underclass in New Orleans was laid bare for all to see on TV. My guess is that this civil unrest will only get worse in the coming months because as unemployment goes up and people get poorer crime tends to go up. Crime already is pretty bad in America; 81 people die a day from gunshot wounds and--this one is kind of a shocking-- 25 people a day over the age of 40 kill themselves.

Now all of this crime has also created an underground economy in the U.S. valued at $650 billion a year that is not taxed. That would be drugs, gambling, prostitution, burglary, and the cash day labor economy. Now the CIA has said that we are the world's largest consumer of cocaine and meth-amphetamine. One of the interesting things the Treasury Department tracks is hundred dollar bills as a share of US currency.

The hundred dollar bill is the currency of the underground economy. Most of us don’t have a lot of hundreds in our pockets but if you’re a drug dealer a hundred is the best way to package as much cash in as small a space as possible. And as you can see, the share of hundred dollar bills, as a share of all US currency, is almost above 70 percent which is rather astonishing.

So this is a Brave New World that is evolving. And of course Aldous Huxley, who wrote a book by that title in 1933 foresaw our current dilemma. Huxley said that the future would not be the boot of George Orwell’s Big Brother, but rather a place where basically we would take our Soma everyday, which was a pill that was a kind of combination Viagra and Prozac and we would go to the “feelies” which would be movies that the chairs moved and we would have this whole world where we’re basically entertained to death. And we would be so entertained that we would not pay attention to the politics of the time. And I would argue that that’s exactly what has happened. We are entertaining ourselves in a way that we have creted a fantasy world where anyone can be The American Idol and Donald Trump can put himself forward as one of the greatest business men in the world even though he has gone bankrupt three times or that George Bush can pretend he is a fighter jockey and declare Mission Accomplished. And this is not just a world for adults. If you’re an eight year old, you can go buy the Bling-Bling Barbie doll and pretend you are a hooker in Vegas and Ken is your Pimp.

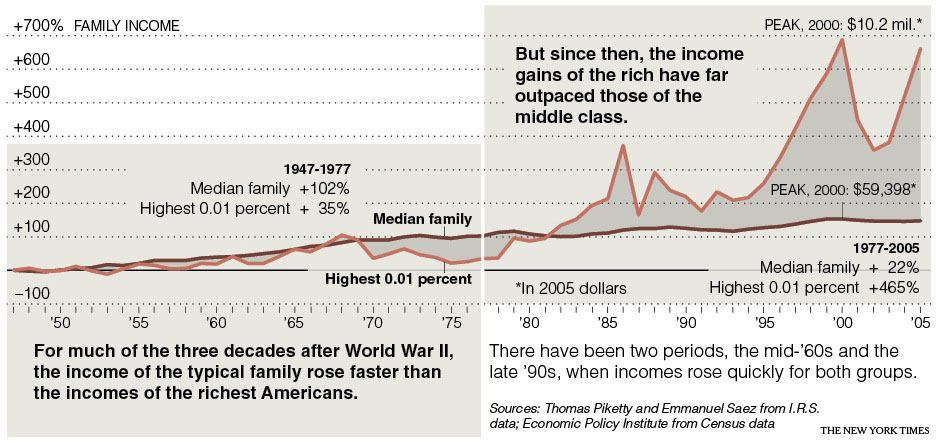

Finally I want to deal with the most insidious part of our decline: the accelerating inequality and the lack of regulation that is the hallmark of the Post -Reagan era. For the first time in a very long time median family income has fallen while productivity is going through the roof.

Now many contemporary economists think this is the big problem because productivity is rising because we're out-sourcing so many jobs to low cost countries, but the average median family income in America is falling. As Alan Blinder who was vice-chairmen of the Fed said 'this is gonna get worse'. He believes that 50 million more jobs could be outsourced and these are service jobs. And you probably aware of this; maybe your x-rays get read in India or maybe your taxes get done in Ireland. We thought that service jobs were domestic jobs, but they are not. But the most egregious sign of accelerating inequality is on this chart. For almost three decades after World War II the median family income was higher, in terms of its growth rate, than the growth rate for the top .01 % of income earners.

And as soon as Reagan got in office you can see that the incomes for the top 1/10 of 1 percent just went through the roof and the median family income began to fall. In other words most of the benefits from 1980 on went to the richest percentage of the population.

Now, one would think that this would lead to some sort of class conflict, but for the average middle class family things seemed great because even though their incomes were stagnant, their real estate values kept rising. But just as fast as home values were going up, people were borrowing against that asset; using their house as an ATM.

But they were only following the lead of the Wall Street Barons who were increasing their own leverage to unprecedented heights. I track the absolute center of the crisis that we're in to a move by the SEC, with George Bush's approval, to basically change something fundamental to our banking system.

And this is a kind of little-known PowerPoint slide from the SEC that was put forth in June 4, 2004 and basically it says that the broker/dealers, that is Goldman Sacks, Bear Stearns, Lehman, may apply to become what is called a CSC a consolidated supervised entity and if they do that, which they all did, they can compute their net capital, in other words how much reserves they needed, by their own internal mechanisms. In other words it used to be that you could not lever your equity as a bank more than 8:1. Bear Stearns got to the point where they were leveraging 30:1. Now Bill Gross who runs the largest bond portfolio named this the "Bank of Shadows" as opposed to the bank of Jimmy Stewart that we all saw in It's a Wonderful Life. Now the bank of Jimmy Stewart had to have a decent loan reserve. But the Bank of Shadows could set the loan reserve to whatever ratio it wanted to. Needless to say, these things have now led to the crash of many, many banks and what will come next is the default of many, many credit card lenders because our non real estate debt is also completely out of whack. Now what made it much worse, of course, was an insane idea called derivatives. And Warren Buffet nailed it; he said "Derivatives are like hell; easy to enter and almost impossible to exit." He called them "weapons of mass destruction".

So this brings us to America 3.0-The way out of this situationAnd my theory is that the technology, telecommunications industries are absolutely gonna be the key to this. I start with some assumptions; that on the day that the next president takes office unemployment will be close to 8 percent, that the Christmas retail season will be the worst in 25 years; and that will lead to many many retail bankruptcies, your malls will be filled with empty, closed up stores, that many more banks will have failed, the states and municipalities will still have trouble borrowing money and the credit cards, defaults and bankruptcies will have climbed significantly. So the task for the next president will be both dangerous and dispiriting.

But we have tools for this recovery. We have models and one of the models I like the best was DARPA. DARPA started in 1958, it's celebrating its 50th anniversary this year . It was the Defense Advanced Research Projects Agency. And basically what DARPA did was figure out a way to seed the computer and network business. And so the invention of the Internet and the networked computer business can be traced directly to DARPA's government money. Market fundamentalists who believe all innovation comes from the invisible hand, don't like to think that the greatest innovation of the late 20th Century came from the government, but that is the fact. But the government invested it didn't do it in a centralized way; it invested in many small research groups in universities like this one and coordinated their research and communication through building an open protocol network called the ARPANET. (They took the "D" for defense out of the name for a while when they realized that what they were developing--a system to allow various radar and missile facilities to communicate over a secure encryptable ip network to a central computer for launch-had profound applications far beyond the defense business)

Sometimes in the depths of this crisis we worry: are we repeating the Great Depression of the 1930's? But there is one great difference between today and 1932-Moore's Law. That simple notion that the computer of 18 months from now will run twice as fast at the same price is fundamental to the way out of our crisis. And Moore's law in some ways mimics the same kind of economics that are going on in the photovoltaic cell world. The power of a 4 square inch photovoltaic cell will double in the next two years. This is the key to our energy dilemma.

What is strikingly different between now and 1958 when DARPA started is that we have new ways of organizing people. And I call it mass collaboration and the most recent demonstration of its power was the campaign of Barack Obama for President. A total bottom-up, networked, knowledge economy that kicked butt in the field against the Top down Republican hierarchy.

This is not unlike the situation at General Motors with its top-down hierarchy that place all the value was in its physical plant and financial ability. And now those physical assets are dragging the corporation into bankruptcy, while it knowledge assets are kept hidden in closets (See "Who Killed The Electric Car"). But now move to a world where value creation began to grow in self-organizing firms in which the critical resources became much more about knowledge creation (Software, Entertainment, Pharmaceuticals) as opposed to the physical assets. And then you look at a business like Cisco which is really just a collection of many small companies organized around a selling force; and very flat organizational structure. And finally you get to a place like Google which is really about mass collaboration in which the self-organizing part of the staff and everything else is crucial and all the value of the corporation is in its knowledge not in its physical assets.

Now one of my mentors, John Seely Brown, always says "all innovation happens at the edge" and I really believe that's true and that's what we've got to do here. So one of the things that I love and some of you have heard me give a talk about the New Federalism and my belief that States can do interesting things, and I'm not gonna talk about that today, but I just want to note that Justice Brandeis's theory that "one of the happy incidents of a federal system is that single courageous state may have it's citizens choose to serve as a laboratory, and try novel social and economic experiments without risk to the rest of the country." It is my belief that in following JSB's theory of innovation at the edge we have to assume that this innovation is gonna have to happen in the states in the same way we passed our own clean car law for California in 2002. Now we can blame Bush's Justice Department for six years of fighting in the courts to enforce the law on the car companies. Imagine where we would be today if 6 years ago every automaker had to start radically improving their fleet mileage (including trucks and SUV's)?

What I want you to do is imagine where we want to be in the year 2020. What would we want as features of this next generation operating system? For me it comes down to four goals. First, I think we want to be energy-independent with a radically reduced carbon footprint. Second, I think we want to have universal healthcare. Third, a world-class public education system from Kindergarten through college that was your right to attend free as a citizen. Finally, we want to have a multilateral foreign policy that has completely rejected the Bush-Cheney notion of "Pax Americana." Assuming that is our end state, how do we take the facts of the current moment into our plan to invest for this future idea of America?

Bill Gross, who runs the biggest bond portfolio in America, says that the problems are so bad that to provide a stable recovery path government spending needs to fill the gap, not consumption. In other words this is not gonna be a recovery driven by people going back to the mall. "Public works program, badly needed infrastructure repairs, as well as large spending on research and development projects should form the heart of our path to recovery." And I believe that's gonna have to be done. So what would R&D plus infrastructure look like? Well it would mean financing thinks like thin film solar film that can be placed on any surface. It would mean putting universal broadband and fiber optics in to homes everywhere. It would mean building new school classrooms that are for the 21st century and not for the 18th century.

So the question then becomes what many on the right are saying 'well we drowned the government in a bathtub and you can't pay for any of your liberal programs ha, ha, ha! Too bad for you." This is the Grover Norquist line and it's nonsense. First off, our gasoline tax is so much lower than the developed world average, that there is zero competitive advantage lost by taxing carbon based fuels. So Tom Freidman has put forth an idea of what he calls the Freedom Energy Tax which would be a phased-in $1.00/gallon tax at the gas pump. That would still put our gas significantly cheaper than Europe or Japan. More importantly, just the gas station part spins off $146 billion a year. And then, if you tax other carbon like coal and natural gas, then you could probably get up to about $300 billion a year in carbon taxes, maybe a little bit more, maybe less. And the idea would be, then, to put that straight out in the form of block grants to the states. So even just from the gas tax California would receive another $31 billion. per year for Alternative fuel investments and purchases. Because the tax was going up you would lower payroll taxes for people who are earning less that $40k a year. Then you would cut the middle-class tax brackets but you'd restore the Clinton-era taxes on the wealthy and you'd raise corporate taxes back to the post-war norm. You will note that much of this is the Obama program, with the exception of the energy tax which is like a third rail in America today but eventually we're gonna have to come to deal with a carbon tax.

But the other interesting thing is that we still can borrow. In fact we borrow cheaper today than we ever borrowed. The yield on a 3-month T-bill today is 0.11 percent. In other words, basically people are giving their money to the government with no expectation of interest whatsoever; just to make sure they get their money back. So because we're the only sovereign credit that everybody wants, our actual borrowing costs are going lower. And so I'm gonna argue from a classic Keynesian fiscal stimulus point of view, we still have a lot of fiscal ammunition, wheras the Fed has almost now interest rate ammunition (you can't cut interest rates below zero. And last week at the six month Treasury bill auctions were way over-subscribed which means that people still want our short term paper.

So what would we do with the capital I just described. Not centrally programmed from Washington, but rather distributed to the states and cities in block grant form for certain kinds of energy efficiency plans. Well the first I think we need to do here in Southern California is to radically enhance our ability to use solar and wind and geothermal for our basic energy grid. And this would mean that we're going to have to build a Smart Grid capable of carrying that power back East So that grid can only come from a kind of national and regional public private investment in the grid and Green Power in general.

I think we also have to accept that nuclear power is going to have to be a part of this. The French run 70 percent of their grid off of nuclear power; they have not had an accident in 40 years. And I think, from the left point of view, this resistance to nuclear power is stupid and when you talk to guys like Stewart Brand who are from the Whole Earth Catalog he has completely come around to believe that nuclear power is an important part of this because, obviously, it is not carbon-based.

The other big infrastructure project I think we need to do is create a modern transportation system. If we had trains that went as fast as the Japanese or the TGV , we could get to San Francisco in two hours on electric powered trains. There are at least six rail corridors in the United States that would relieve an extraordinary amount of commuter air problems which are happening. This map of our country at night clearly shows the major population concentrations that could use high speed rail commuting.

Needless to say, the Boston to Washington is one but that's not running half as fast as the Japanese trains. The Chinese just tested a mag-lev train that goes 300 mph. So there is no point for us not to do this because (a) an electric-powered train is very low polluting and, needless to say, one of the big problems is congestion. Airport congestion is one thing that we could relieve fairly quickly. The second element of a modern transportation system would be a wholesale embrace of plug-in hybrid cars. Google just ran a one year experiment and found that a plug-in toyota Prius can average 96 miles to the gallon. That alone would reduce our dependancy on foreign oil by a substantial amount.

I also, as you know, am on the California Governor's Broadband Policy Taskforce. and I actually think we could get to universal broadband easily in the next few years Jet Blue gives their reservation agents a computer and a broadband modem and network in their house. They work on four-hour shifts, so they don't have to pay for childcare. And so every time you call Jet Blue you're reaching someone in their house who's working as a reservation agent. So Jet Blue did the right thing. They didn't outsource it to India; they outsourced it to people working in their house in Kansas.

Finally we have to deal with the basic infrastructure-roads, bridges schools office buildings. Needless to say, as we all know from what happened in Minneapolis last year, there are thousands of bridges and roads built during the last depression 75 years ago. And ever since the Reagan anti tax ayatollahs got into power we haven't maintained our infrastructure. So all of this rebuilding will put people back to work,

In terms of education not only do we have to make our schools better but we have to pay our teachers a lot more. The average Korean high school teacher gets 2.5 times the average income in Korea. The average US high school teacher gets 1.2X the average income. So we have got to raise teacher salaries and cut classroom size.

Finally, we need to put in universal healthcare. And it will be expensive but it will actually save us a lot of money. The recent Mckinsey report said that we pay an excess of $98 billion a year in administrative costs just because we have so many duplicative bureaucracies at the insurance companies and more than half of that is for marketing. We also pay huge excess of any other country in the world for our drugsbecause of import limitations.

So I'd like to close by saying that I think the key to getting out of this terrible crisis is a very powerful investment by the government in both ET--energy technology, and IT--information technology. and I think it's really incumbent on the universities to be at the center of this revolution. Because if we don't recognize the seriousness of this moment and start investing on the scale I have discussed, we could limp along like Japan for ten years; in a flat economy and the social strife that would result from that would be disastrous. I am aware that getting the political will to do this is hard, but perhaps it takes a crisis to move this country of ours.

Thank you.